Introduction to Stock Investing and Market Trends

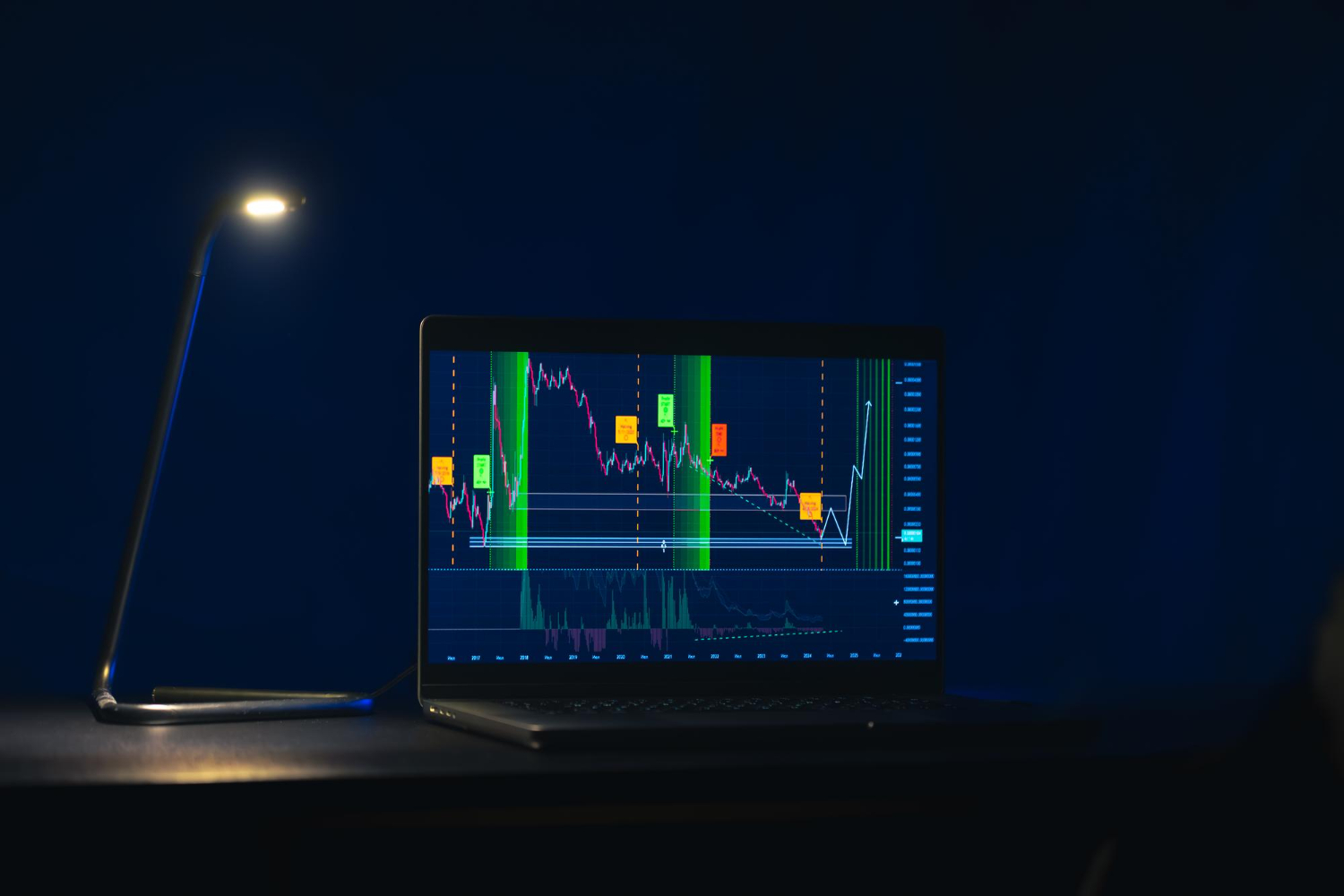

It is a dynamic platform that offers numerous opportunities for investors seeking to grow their wealth. As of now, the stock market exhibits a variety of emerging trends and industries that are well-positioned for growth over the next few years. Comprehensive analysis reveals that identifying stocks ahead of their potential peaks is crucial for maximizing investment returns. This approach requires an understanding of current market indicators and the ability to discern which companies may outperform their peers.

In recent times, certain sectors have shown significant promise. Technology, renewable energy, and biotechnology are just a few examples of industries that are rapidly evolving and attracting considerable attention from investors. These sectors are not only shaping the future of our economy but are also presenting unique investment opportunities characterized by innovation and high demand. Investors must stay informed about key developments within these industries, as timing the market can significantly influence the success of any stock purchase.

Evaluating potential investment opportunities involves conducting thorough research, including analysis of a company’s financial health, industry position, and growth trajectory. Metrics such as price-to-earnings ratios, earnings growth rates, and market share are critical in assessing whether a stock is undervalued or poised for a significant upturn. Additionally, market sentiment and external factors, such as government policies and economic conditions, can drastically affect stock performance.

Ultimately, the essence of stock investing lies in strategic decision-making and the anticipation of future trends. Understanding market behaviors and being able to predict which stocks are set to thrive can lead to substantial financial rewards. With careful analysis and timely investments, one can harness the potential for impressive returns in this ever-evolving financial landscape.

Stock 1: [Name of the Stock]

[Name of the Stock] stands out in the current market due to its robust business model and strategic positioning within its industry. The company has consistently demonstrated a commitment to innovation and customer satisfaction, which has translated into impressive revenue growth over recent years. With a strong portfolio of products, [Name of the Stock] has managed to carve out a significant market share, positioning itself as a key player among its competitors.

In examining its financial metrics, [Name of the Stock] has reported a steady increase in revenue, showcasing a compound annual growth rate (CAGR) that outpaces industry averages. Profit margins have remained resilient, reflecting the company’s efficient operational strategy and cost management practices. This financial stability is a critical factor for investors, as it indicates the company’s ability to weather market fluctuations while continuing its growth trajectory.

Furthermore, a comparison with industry counterparts reveals that [Name of the Stock] not only excels in revenue generation but also in customer loyalty and brand recognition. These competitive advantages are essential as they provide a solid foundation for future expansion and market penetration. The company’s brand strength serves as a buffer against economic downturns, ensuring sustained demand for its products.

Looking ahead to 2025, several upcoming catalysts are poised to drive [Name of the Stock] towards explosive growth. Notable product launches are on the horizon, along with strategic partnerships that are likely to enhance its distribution network. Additionally, potential expansions into emerging markets could significantly amplify revenue streams and enhance the company’s global footprint. All these factors collectively suggest that [Name of the Stock] not only possesses strong fundamentals but also the potential to deliver substantial returns for investors in the near future.

Stock 2: Acme Technologies

Acme Technologies has emerged as a prominent player in the technology sector, distinguished by its innovative product offerings and a strong market position. With a focus on software development and cloud computing solutions, Acme has capitalized on the increasing demand for technology services. The company’s ability to adapt to market trends and leverage cutting-edge technologies has positioned it well for substantial growth in the coming years.

Financially, Acme Technologies presents a robust picture. The latest earnings report indicates a steady increase in revenue, with a year-over-year growth rate of 25%. The balance sheet reveals a healthy asset-to-liability ratio, suggesting sound financial management. Coupled with a consistent track record of profitability, these metrics are positive indicators for investors looking to buy shares of Acme before 2025. The company holds a substantial cash reserve, which enables it to invest in research and development, further enhancing its competitive advantage over peers.

Macroeconomic factors such as rising demand for digital transformation across various industries and increased IT spending are likely to bolster Acme’s performance. The global push towards remote work and digital solutions has created an expanded customer base for the company. However, investors should remain vigilant about potential risks such as market volatility, regulatory changes.

Despite these challenges, Acme Technologies is positioned for significant growth as it continues to innovate and expand its service offerings. With projected revenue increases and strategic investments ensuring ongoing development, the stock is likely to see considerable appreciation before 2025. Investors eager to tap into the potential of the tech sector should consider acquiring shares of Acme Technologies for their portfolios.

You can also read : The Truth About Risk-Free Investments: It’s Not What You Think

Conclusion: Diversifying Your Portfolio and Future Outlook

As we look to the future, the investment landscape for 2025 presents a plethora of opportunities. Particularly with the five stocks highlighted in this post. These stocks are set to experience considerable growth due to market trends, technological advancements, and their underlying business models. However, while the prospects for these individual stocks are promising. It is crucial to understand the importance of diversification within your investment portfolio.

Diversification is a proven strategy that helps mitigate risks associated with market fluctuations and unanticipated events. By spreading investments across various sectors, including the aforementioned stocks, you create a buffer against potential downturns. This approach not only safeguards your capital but also enhances the potential for stable, long-term returns. Incorporating these stocks into a broader investment strategy should involve assessing your risk tolerance. Aligning your investments with your financial goals.

When considering how to effectively include these stocks, a staggered investment approach may be beneficial. This could involve incremental purchases over time rather than committing a lump sum all at once. Additionally, regularly reviewing and adjusting your portfolio can ensure that your investments align with changing market conditions and personal objectives.

Looking ahead to 2025, the overall market outlook is increasingly optimistic, driven by economic recovery and technological innovation. Stocks that exhibit strong fundamentals, innovative growth potential, and resilience are likely to lead the charge. The stocks identified in this analysis certainly hold exceptional promise. Positioning yourself early could yield significant rewards as their value is expected to increase. Therefore, taking decisive action today could enhance your portfolio’s performance and provide substantial returns in the near future.