Introduction to Budgeting and Its Importance

Budgeting is the methodical process of creating a plan to spend your money, allowing individuals to manage their finances effectively. At its core, a budget serves as a roadmap for personal finance, providing clarity on income, expenditures, and savings goals. Establishing a budget is essential for tracking spending, as it empowers individuals to see exactly where their money is going, thereby facilitating informed decisions about their finances.

The benefits of having a budget are manifold. Firstly, budgeting enables individuals to set financial goals, whether these involve saving for a major purchase, paying down debt, or preparing for retirement. A well-structured budget lays out the necessary steps to achieve these objectives, providing motivation to stay on track. Furthermore, by closely monitoring spending habits, individuals can identify areas where they can cut back, thereby ultimately increasing their savings over time.

Despite its advantages, many individuals encounter common budgeting challenges, such as underestimating expenses or straying from the plan due to unexpected costs. These hurdles can lead to frustration and decreased motivation to maintain a budget. However, utilizing a budget spreadsheet simplifies this process significantly. For starters, a spreadsheet enables users to input and manage all financial data in one convenient location, making it easier to visualize budgeting progress. Additionally, many free budget spreadsheet templates are readily available, providing customizable features that cater to individual financial situations, which enhances usability.

In conclusion, understanding the importance of budgeting is vital in today’s financial landscape. By creating a budget and overcoming personal financial challenges with the help of a structured approach, individuals can unlock their potential for financial success. Implementing the right budgeting tools, such as budget spreadsheets, can serve as an indispensable asset in this pursuit.

Features to Look for in Budget Spreadsheet Templates

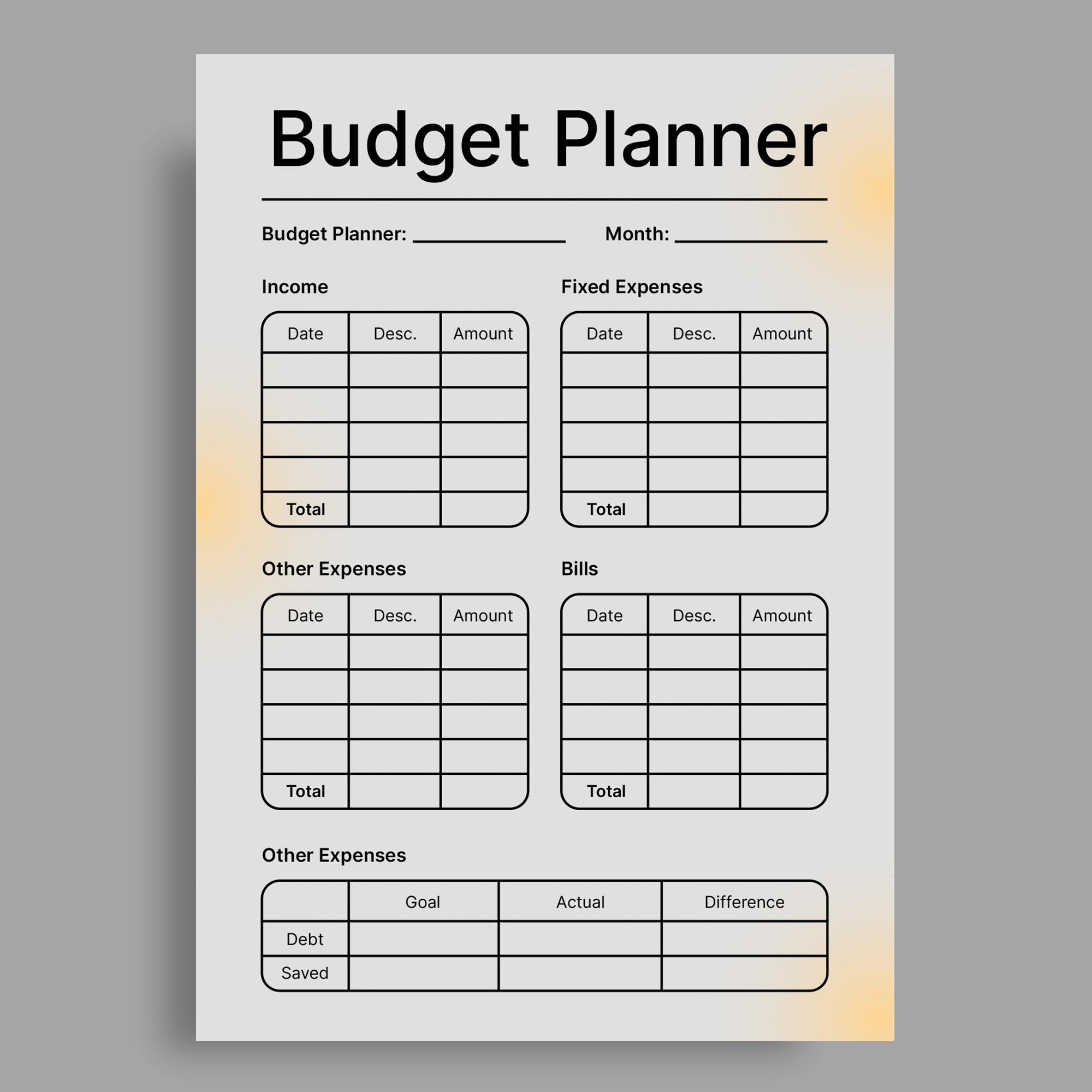

When evaluating budget spreadsheet templates, several key features are critical to ensuring an effective financial management tool. The primary attribute to consider is user-friendliness. A well-structured budget template should have an intuitive layout, allowing users to navigate through different sections effortlessly. This ease of use encourages regular engagement with budgeting practices, ultimately leading to better financial awareness.

Another important aspect of budget spreadsheet templates is customization options. Users have unique financial situations, so the ability to personalize the template is invaluable. Effective budget templates should allow individuals to modify categories according to their specific income sources and expenditures. Users might appreciate the flexibility to include personal financial goals and preferences, creating a tailored budgeting experience that fits their lifestyle.

Expense tracking capabilities are also essential in a budgeting template. A robust template should provide clear sections for detailing income and expenses, making it simple to monitor financial performance over time. This tracking process is integral to identifying spending habits and recognizing areas where expenses can be reduced. Thus, a good budget spreadsheet should facilitate detailed input for all financial transactions, enhancing the overall budgeting experience.

Furthermore, the visual representation of data through graphs and charts significantly enhances the comprehension of financial data. Many users find visual aids helpful for quickly identifying trends and making informed decisions. A budget template that includes these visual elements can lead to a more dynamic engagement with one’s finances.

Lastly, automated calculations are a crucial feature that saves time and enhances accuracy in budgeting. A well-designed budget spreadsheet should automatically update totals as new entries are made, minimizing errors commonly associated with manual calculations. These features collectively contribute to creating an effective and efficient budgeting tool, serving as a review platform for personal financial management.

Top Free Budget Spreadsheet Templates Available Online

In an era where effective financial management is essential, utilizing free budget spreadsheet templates can significantly streamline the budgeting process. This section presents a curated selection of the best free budget spreadsheets readily available for download, each tailored to meet diverse user needs.

One standout option is the Monthly Budget Template from Vertex42. This user-friendly spreadsheet allows individuals to track their income and expenses while offering a clear overview of financial health. With built-in categories for essential expenses, it is ideal for families seeking to manage their household budget effectively. Downloading this template is straightforward through the Vertex42 website.

For students, the Student Budget Template from Google Sheets is an excellent choice. Designed specifically for those managing limited finances, this template includes sections for both income and school-related expenses. Its collaborative features make it easy for students to share and adjust their budgets with peers. Accessing this template can be done through the Google Sheets platform.

Freelancers may benefit greatly from the Freelancer Budgeting Spreadsheet found at Tiller Money. This template is tailored to accommodate irregular income streams and variable expenses, allowing freelancers to create a realistic and adaptable budget. Users can find it by visiting the Tiller Money website, where they can also subscribe for additional financial tools.

Moreover, the Annual Budget Template by Smartsheet offers a long-term perspective on financial planning, making it suitable for anyone wishing to evaluate their financial standing over a year. Featuring summarization tools and flexible customization options, it caters to various users, from individuals to small businesses, and is available for free download from the Smartsheet website.

These templates represent just a fraction of the free budgeting resources available online. By selecting the one that aligns best with their financial circumstances, users can enhance their budgeting experience and work toward achieving greater financial success.

You can also read : The 7 Best Personal Finance Apps to Manage Your Money

How to Effectively Use Budget Spreadsheets for Financial Management

Implementing budget spreadsheets into your financial management can significantly enhance your ability to track and control spending. The first step is to set clear financial goals. Whether you aim to save for a vacation, reduce debt, or build an emergency fund, having defined objectives will guide your budgeting process. When entering data into the spreadsheet, categorize expenses clearly—fixed costs such as rent or mortgages, variable costs like groceries, and savings goals. This will lend clarity to your financial picture, allowing you to make informed decisions.

Regular updates are crucial for accurate financial management. Consider recording your expenditures daily or weekly; frequent updates prevent overlooking expenses that might derail your budget. Most budget spreadsheets will allow you to monitor trends over time, which can be incredibly useful. For instance, tracking spending patterns month-over-month could reveal unanticipated expenses or highlight areas where you can cut back. Don’t forget that budget spreadsheets can often automate calculations, making it easier to maintain an objective perspective on your financial standing.

Monthly reviews of your budget should become a cornerstone of your financial routine. Dedicate time at the end of each month to compare your actual spending versus your projected budget. This evaluation not only promotes accountability but also helps you adjust your strategies to better align your actions with your financial goals. Additionally, integrating budget spreadsheets into your daily routines—perhaps by reviewing them during a coffee break or setting reminders—will ensure they remain a prominent aspect of your financial management, enhancing overall efficiency in achieving your goals.