Introduction to Budgeting and Its Importance

Free budgeting worksheets is the systematic process of creating a plan to manage financial resources effectively, ensuring that one’s expenses do not exceed income. It serves as a fundamental financial tool that empowers individuals to gain control over their finances, track spending patterns, and allocate resources towards savings and investments. The importance of budgeting cannot be overstated, especially in today’s fast-paced economic climate where financial responsibilities often seem overwhelming.

One of the primary benefits of budgeting is its ability to help individuals monitor and track their expenses. By carefully examining where money is spent, individuals can identify areas of unnecessary expenditure and make informed decisions on adjustments. This tracking not only aids in immediate financial management but also fosters awareness that can lead to better spending habits in the long run.

Moreover, effective budgeting encourages the practice of saving money. By setting aside funds for emergencies, future investments, and major purchases, individuals can mitigate financial stress and build a secure financial foundation. This proactive approach to saving also aligns with the broader goal of achieving financial stability, enabling individuals to work towards their aspirations, such as home ownership, travel, or retirement.

In addition to aiding personal financial management, budgeting provides a framework for achieving financial goals. Whether the objective is to pay off debt, save for a child’s education, or prepare for retirement, a well-structured budget can help prioritize spending and ensure that resources are allocated in alignment with these goals.

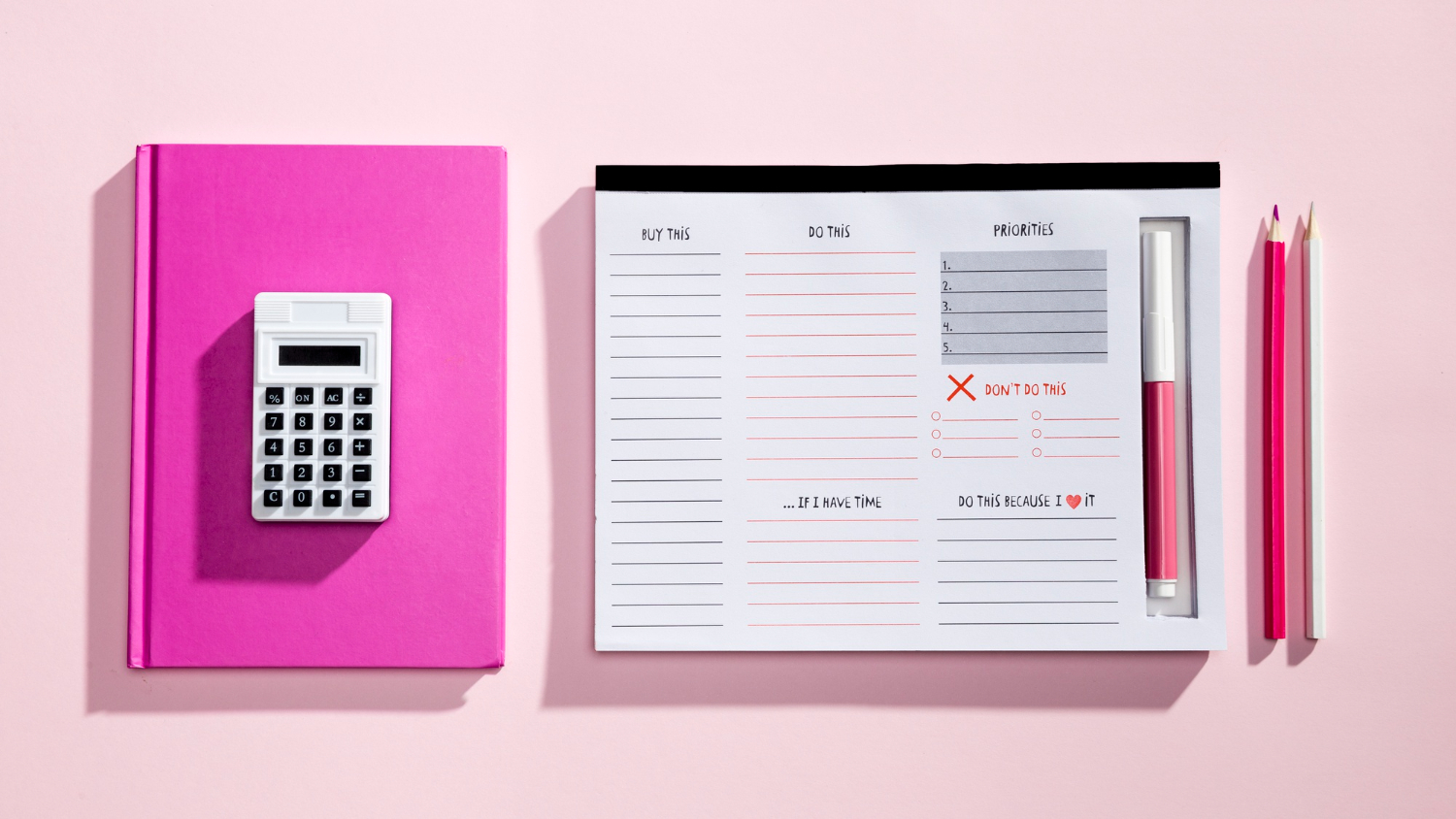

To facilitate the budgeting process, utilizing printable worksheets can be a valuable resource. These templates simplify the process of tracking income and expenses, making it easier to maintain discipline in financial management. By adopting practical tools such as these worksheets, individuals can enhance their budgeting efforts and foster a more secure financial future.

Overview of the 5 Printable Budgeting Templates

Free budgeting worksheets plays an essential role in managing personal finances, and the availability of flexible budgeting worksheets can assist individuals in tailoring their financial plans. This section introduces five printable budgeting templates, each showcasing unique features designed to cater to various financial needs and budgeting styles.

The first template, the Basic Monthly Budget, is ideal for individuals seeking simplicity. It breaks down income versus expenses in a straightforward manner, making it easier to track monthly spending and savings goals. Users can easily fill out their fixed and variable expenses, ensuring they stay within limits while adapting their financial planning throughout the month.

Next is the Zero-Based Budget Template, which is designed for those who prefer a proactive budgeting approach. This template requires users to allocate every dollar they earn, ensuring that income is fully used towards expenses, savings, or debt repayment. By encouraging users to justify each expense, it promotes mindfulness around spending habits.

For families or households with multiple income sources, the Family Budget Tracker provides a comprehensive solution. This template allows users to account for various income streams and expenses associated with family life, which can include groceries, childcare, and entertainment. The collaborative approach enables families to work together toward shared financial goals.

The Debt Reduction Planner template is tailored for individuals focused on eliminating debt. It includes sections to list debts, such as credit cards or loans, along with payment schedules. By tracking progress towards reducing liabilities, users can visualize their journey to financial freedom.

Last but not least is the Savings Goal Tracker. This template assists users in setting and tracking specific savings targets, whether for short-term goals like vacations or long-term objectives like retirement. Visual aids within the template can motivate individuals to achieve their savings milestones, making it an invaluable tool for effective financial planning.

Detailed Breakdown of Each Budgeting Worksheet

In exploring the five printable budgeting worksheets, it is essential to understand how each template can serve different budgeting needs and help streamline your financial planning process. The first template is the basic monthly budget worksheet. This design is straightforward, allowing users to allocate income to various categories such as housing, utilities, food, and entertainment. Its ease of use makes it ideal for beginners, while experienced budgeters might find it a solid foundation upon which to build more complex plans.

The second template focuses on expense tracking. This worksheet is particularly beneficial for those who want to scrutinize their spending habits closely. Users can categorize expenses by type and record details for accuracy. To maximize this template’s effectiveness, consider maintaining it regularly and analyzing trends over time. This practice can reveal opportunities for trimming unnecessary costs.

Savings Goals

Users can set specific financial targets, whether for an emergency fund, vacation, or large purchase. This template’s visual aids can motivate users by illustrating progress towards each goal. For optimal results, users should consider setting realistic deadlines and adjusting their savings strategies as needed.

The fourth template serves those who are looking to manage their debt effectively. This worksheet enables users to list outstanding debts, including interest rates and payment schedules. By using this template, individuals can prioritize which debts to tackle first using methods such as the snowball or avalanche approach, ultimately improving their financial health over time.

Finally, the fifth free budgeting worksheets combines various budgeting approaches into one comprehensive template. This versatile worksheet allows users to summarize monthly income and expenses while also tracking savings and debt repayments. It suits those who prefer a holistic view of their finances. To make the most of this resource, consider regular reviews to refine your budgeting strategies and set annual financial objectives.

You can also read : Budgeting for Freelancers – Smart Tips for Irregular Income

Getting Started with Your Budgeting Worksheets

Embarking on your budgeting journey can be both exciting and overwhelming. However, utilizing budgeting worksheets can simplify this process significantly. Once chosen, download and print the worksheets, ensuring you have ample copies for various budgeting periods, such as monthly or weekly.

After printing, it’s essential to familiarize yourself with each sheet. Allocate some time to read through the instructions and understand how to categorize your income and expenses. Begin by filling in your current income sources, followed by your fixed and variable expenses. This exercise will provide clarity on your financial situation and highlight areas where you can make adjustments.

Maintain consistency in using your budgeting worksheets. Set aside dedicated time—perhaps at the end of each week or month—to review your financial progress. During these reviews, assess whether you are adhering to your budget or if adjustments are necessary. Circumstances can change, and your budget should be flexible enough to accommodate those changes, ensuring that it continues to serve its purpose effectively.

Additionally, staying motivated is crucial. Remember that taking control of your finances is a significant achievement. Celebrate your progress, no matter how small, as each step brings you closer to financial stability. Consider tracking long-term goals alongside your worksheets, allowing you to visualize your financial journey more holistically.

In closing, embracing free budgeting worksheets invites a positive approach to financial management. These practical tools empower you to take action, creating a clear path toward a better understanding of your finances and sustainable economic well-being.